Airports are often associated with a negative reputation regarding baggage. Despite being designed to be large and sometimes even luxurious, the long lines, challenging security measures, strict regulations, and overall discomfort can make them stressful or even dreadful places.

Contributing to the already unpleasant experience are the occasional dramas such as overbooked flights, weather-induced delays, intrusive security screenings, and other travel-related problems that tarnish the reputation of airports. However, there’s always a bright side to everything. Despite the stress and discomfort, there are plenty of enjoyable moments to be had, each one potentially erasing the negative vibes. The pictures you’re about to see demonstrate that airports can be great places to witness odd things and have a good laugh.

Extended Wait Times

This is a picture that every traveler can resonate with. Most of you reading this have likely slept in an airport after enduring long hours of waiting. Delayed flights are always a hassle, but the situation becomes even more stressful when all the hotels are fully booked (or you’re trying to save money) and you have nowhere else to stay!

If you’ve ever experienced a significantly delayed flight, you can likely empathize with this girl’s need for rest. But using these benches as a makeshift bed? That’s inventive.

and

Economical. What a great way to handle a difficult situation, and that’s the first rule for dealing with delayed flights!

Yes, indeed!

This is reminiscent of Austin Powers, minus the heels. In fact, the heels are fitting too since Austin loved his platforms. As for us, we love that this guy can walk confidently in heels but still carries a flip phone.

What’s Actually Inside That Bottle?

Although we’re pretty certain that flight attendants aren’t permitted to consume alcohol while working, everything about this image suggests they might have had a few drinks.

A Sticker Album for People

A long layover is a nightmare for any parent with small children, and this dad is definitely stepping up for the family. Once he removes them from his hairy arms, he might regret his choice.

Yoga Session on the Go

While striking a yoga pose on a moving walkway at an airport might not be the wisest choice, it is undeniably captivating. Even if she manages to stay balanced, she might still receive a caution from the security staff.

It would be incredible to witness what happened after this moment. Without any photographic proof, all we can do is laugh and be astonished at how this woman came up with the idea to do this in an airport. Perhaps it was a dare? Or maybe she simply needed to do yoga before her flight? If that’s the case, then she’d definitely score 10 points for remarkable multitasking!

Tons of Distractions

It’s not common to encounter someone with celebrity-level attractiveness at an airport, and the person who captured this photo was likely taken aback by such beauty. They probably never imagined that a plain white tank top could look this great, right? Once again, achieving the most impact with minimal effort! That’s our saying for today.

The young woman with gorgeous tan skin and balayaged hair is clearly catching everyone’s eye, if not causing them to turn their heads excessively. It must have been difficult for the TSA employees to concentrate on their duties due to her distracting beauty!

It actually appears quite fashionable…

If you feel offended by this picture on behalf of Jewish people, please don’t: the author of this article is Jewish, and in my view, the person looks absolutely striking. Red underwear has always been appealing, and the fluffy items hanging on both sides (not the sidelocks, but the red things in the picture) create a perfect harmony of color, shape, and texture. It’s a perfect example of style as timeless as the cherished traditions of my people.

When you’re feeling stressed from all the waiting and standing in line at the airport, sights like this can quickly lift your spirits. The man appeared to be waiting for someone to arrive; we hope that person shares the joke with him so he can laugh along with us.

I can’t believe how you move it.

(The mention was in reference to a song by Eminem. Just a heads up. Anyway,) Once you use a high-quality neck pillow on a long flight for the first time, you’ll understand why frequent flyers are so fond of them. They provide great neck support as you attempt to sleep through the monotonous and sometimes bumpy journey. Additionally, if you manage to time your sleep well during the flight, you can effectively beat the notorious jet lag.

Although this woman will likely enhance her flying experience by bringing along a neck pillow, she may want to reconsider the color and position of this accessory. We just hope she wasn’t too embarrassed when someone eventually brought it to her attention.

Mary was observing quietly.

What’s the best way to keep your child out of a dirty restroom? By carrying them on your shoulders and letting them navigate through the crowd.

In-flight Nap

Here’s another part of the ‘wild airport nap’ series. Check out how calm the guy’s face looks despite his uncomfortable position! It might appear that he’s in a less-than-ideal sleeping posture, but his expression suggests otherwise.

We’re starting to believe this could have been the best nap he ever had. We just hope he managed to catch his plane on time. Also, take a look at the person behind him. Is he sprawled across the chair armrests? That surely can’t be comfortable!

Being young is a virtue.

These two flight attendants are young and inexperienced, as they wouldn’t appear as pleasant if they had several years of experience.

Customized Suitcases

This suitcase is hard to misplace. It’s unlikely anyone would steal it because you can easily recognize who took it. While it might look a bit odd, it’s an effective way to prevent theft.

There are several ways to integrate this into your personal style. You could get your name printed on your luggage or, if you’re feeling as daring as the man mentioned, you could use your favorite selfie!

Minka Kelly Appears Gorgeous At LAX Airport

If you’re hoping to spot stunning celebrities effortlessly making an appearance, consider visiting LAX International Airport. LA is well-known for its star-studded population, so this could be your chance to fulfill your fan dreams!

Consider, for instance, this picture of the beautiful Minka Kelly, a Friday Night Lights an actress. You can see her getting ready to leave the airport for an early morning flight to start her well-deserved vacation. Isn’t it amazing how great she looks? Bon voyage, sis!

This Is NOT the Way to Transport Your Kids

If there’s one thing more disliked than turbulence, it’s noisy toddlers and infants crying continuously. Everyone just wants to survive the flight by sleeping, watching movies, or contemplating their plans after arriving. So, it’s understandable to feel frustrated by a noisy child.

Observe this little child just clutching onto her father’s suitcase that has become a moving bed. She must be exhausted from all the traveling. At least she’s not causing a disturbance by crying!

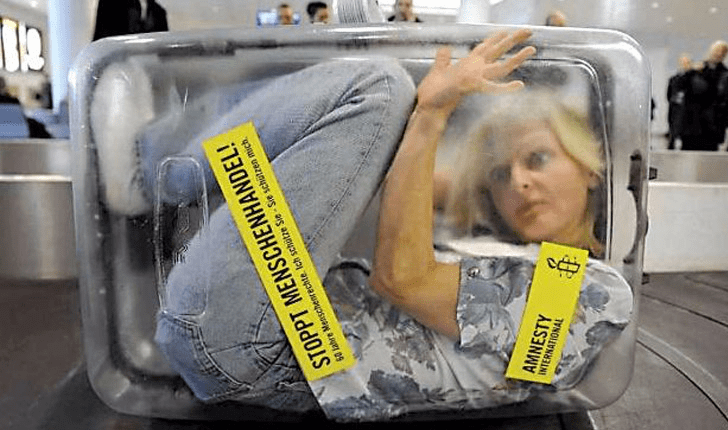

Suitcases with a Purpose

Everyone has the right to express their opinions. Some do so to share their own message, while others aim to benefit the world. Although considering global issues can be challenging, particularly when dealing with personal problems, we admire those who advocate for the well-being of others.

There are numerous ways to raise awareness for your cause, and this person executed an exceptionally creative protest. This suitcase here symbolizes human trafficking; it serves as a reminder of a persistent issue that requires discussion so it can ultimately be resolved. What a courageous airport activist!

The Rock is likely carrying smaller rocks.

Why not? He’s strong enough to do it. Everyone knows The Rock is a giant, so his large hand-carry luggage seems quite fitting for him. But imagine if someone else tried to carry it! Surely they must have been sent back to check that in.

The size of the bag is one aspect, but what about the design and material? We want one in every color! It seems like Dwayne Johnson has a great sense of style and knows what looks good. But what do you think he carries inside it?

This is also not the correct way to transport your crocodiles…

The airport isn’t exactly recognized as a pet-friendly environment. It’s understandable, given that not everyone is comfortable around animals. Therefore, pet owners should be mindful of others’ needs if they have to bring their animals along.

This is a smart method for customs to reach their target audience, informing individuals that if they have anything concealed in their luggage, it’s better to declare it upfront. Yet, every day, people attempt to sneak things even more unusual than a crocodile through border security!

This Is Not the Way to Transport Your Deceased Relatives

It’s difficult not to link boredom with airports since it’s almost always a problem. If you look at the departure lounge of any airport, you’ll see a sea of people all doing one thing: waiting.

This person clearly understands the need to conserve energy until it’s his time to act. He doesn’t plan to remain standing and awake for hours unnecessarily. Is it brilliant or foolish? You decide!

Not That Way.

We might never find out why this person chose to sleep by the bathroom, but what we do know is that this picture is funny. We only hope he managed to wake up in time to catch his flight.

We’ve all experienced it – being late for our flight and ultimately needing to purchase another ticket. But what if the next available flight isn’t until the next day? We hope this gentleman, who seems to have dozed off, didn’t have to face such problems when he woke up!

It’s Thanksgiving! Get the kids! We’re leaving the country!

Some individuals are committed to having turkey for Thanksgiving, regardless of the effort involved. Consider, for instance, this turkey that was flown through the air so that a family could have it on their table. That’s dedication to tradition!

Thanksgiving is among the most cherished holidays in the US, and it wouldn’t be the same without a turkey (and some full bellies). We hope this turkey was spared, though the chances are low.

May the Airforce be with you.

Is there an intergalactic conflict happening that we’re unaware of, or has the TSA simply received some impressive technological enhancements? We genuinely hope these are the new airport security uniforms being introduced, as it would certainly make the check-in process far more interesting.

We are confident that all the

Star Wars

Fans at the event were snapping lots of selfies with the stormtroopers. It seems the force is strong in this airport. Get it? No? Bad joke? Alright.

Amazing Parking Abilities

If you think parking at airports is challenging, just imagine parking an airplane! Numerous things can potentially go wrong. This is why pilots invest a lot of time in training, mastering how to safely maneuver these huge aircraft.

Do you have trouble with reverse parallel parking? If you do, you can definitely relate to these unfortunate pilots and their parking mishap. Picture the ordeal of parking a massive plane after a lengthy flight, only to hear (and feel) that dreadful metallic crash as you collide with another aircraft. Ouch!

Excessive Duty-Free Jack Daniels

Here’s an unexpected photo that instantly went viral once it was posted online. The takeaway lesson? When the flight attendants say you can unbuckle, they mean just your seatbelt!

It’s fortunate his face wasn’t visible in the picture; otherwise, he might feel quite embarrassed about his viral fame.

This one is likely drunk as well.

If any of this pilot’s passengers witnessed this, they might have been alarmed. Seeing a pilot asleep during a flight isn’t very reassuring. But there’s no need to worry; there are always two pilots operating the plane, and they can alternate their duties!

Although there is indeed an auto-pilot feature, human supervision and input are crucial. So no need to worry, everyone, the person who took this photo is probably his co-pilot!

Take me to the paradise city, where the boots are pink and the men are attractive.

Las Vegas is a vibrant city, likely one of the most renowned in the world. Visitors can enjoy partying, gambling, getting married, and pursuing various activities for fun and living in the moment.

Vegas fans – have you encountered a high-roller like this? His completely pink outfit is a bold choice, but we’re not complaining! We appreciate that he adds a burst of color against a dull background.

I have 99 people, but the plane hasn’t arrived.

We were always advised to arrive at the airport as early as possible before a flight. This ensures you’re ready and calm, without worrying about traffic jams or unexpected events making you miss your flight. However, these individuals took readiness to an entirely new level.

Regardless of whether this was staged, it’s still a humorous photo. We’re a bit concerned for them since the stairs look quite unstable with so many people piled on them. We hope everyone was safe after they took the picture.

Jenga: The Luggage Collection Version

This photo of suitcases piled together to form a giant luggage monster at the airport is so reminiscent of the anxiety-inducing block stacking game. But luggage-Jenga is much riskier – one wrong move and you’re in a tough spot! Kids, don’t try this at home.

Do you believe this is genuine? Or is it an art installation meant to highlight some luggage-related problem? We have numerous questions about this, including ‘How on earth did they manage to stack them like that?!’

Denver International Airport’s Conspiracy Central

For all the conspiracy enthusiasts out there, visiting the Denver International Airport (DIA) could be one of the most exciting experiences. Why? Because it’s not just a travel hub, but also a place where conspiracy theories seem to come alive.

The DIA is a center for conspiracy theories where you can find sculptures and images related to the Illuminati, underground cities, as well as the 32-foot blue bronco sculpture known as the ‘Blucifier,’ featuring its striking red eyes and symbolizing one of the horsemen of the apocalypse.

What The Los Angeles International Airport Looked Like In The 1960s

Everyone enjoys retro vibes, given how cold and impersonal modern airports often feel. It’s invigorating to experience a throwback to the past amid a flood of contemporary concepts, designs, and looks.

At LAX, there is a structure called the ‘Theme Building,’ which was developed by the renowned architecture firm Pereira & Luckman. Its design is intended to mimic a UFO landing in the middle of a parking lot, and it houses a restaurant fittingly named ‘Encounter.’

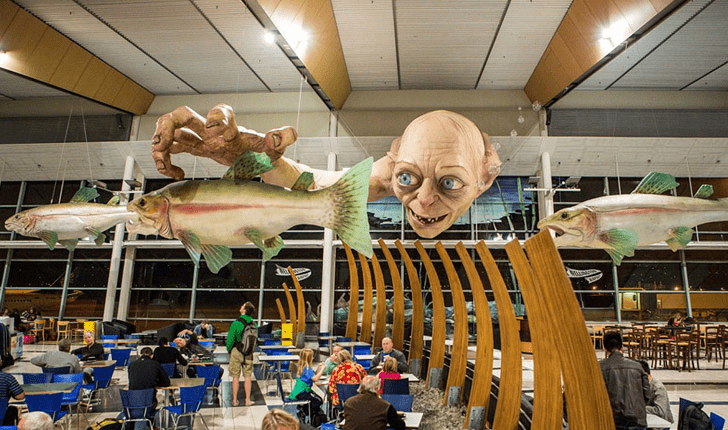

Airport Edition of Lord of the Rings

New Zealand is a remarkable country with breathtaking landscapes and numerous exciting adventures to experience. It’s no surprise that tourism is thriving there, and as a result, Wellington Airport greets thousands of visitors from across the globe annually.

Passengers are greeted here by a huge hanging figure of Gollum.

The Lord Of The Rings

and

The Hobbit

The character is shown attempting to catch fish, looking both charming and eerie as usual. Many Middle-Earth fans who visit the filming location are likely thrilled by this impressive welcoming structure!

Be Cautious of the Polar Bear

It seems there will be flight delays until the airport staff removes a bear that’s found its way onto the runway. How do you think the staff announced this situation? Maybe with a pun like “Please ‘bear’ with us”? If they didn’t, we certainly would have!

Unfortunately, polar bears have been facing starvation due to the loss of their habitat. As the ice melts, they are gradually dying. This is likely why this bear is seeking food in areas frequented by humans, rather than on the ice.

An Enjoyable Resolution

We believe that everyone here has likely been late at some time in their life. Unplanned situations like traffic or oversleeping can occur, leaving you rushing to get to the airport on schedule.

Changi Airport in Singapore acknowledges this problem and attempted to solve it with a creative and entertaining solution. They installed a four-story slide that spirals and curves through the terminals to reduce the likelihood of passengers missing their flights.

Bathroom Suitable for Pets

We absolutely love places that welcome everyone. Inclusivity is crucial for creating a joyful society and should embrace all races, genders, sexual orientations, spiritual beliefs, and even pets! Take a look at how much consideration went into designing this bathroom.

Hats off to the person who came up with this design idea! It’s amusing, adorable, and genuinely brilliant! The addition of fire hydrants was a great choice, and we’re certain all the guide dogs and service animals enjoy using it!

Error in landing

When we saw this, one thought struck us: we hope everyone was alright! The crash seems quite serious, but we hope the consequences weren’t too severe. How did the vessel end up in that situation in the first place?

Perhaps the runway was too slippery due to all the ice, or there might have been a significant malfunction with the airplane. Fortunately, it doesn’t seem like it will explode, which is reassuring. Always be cautious while flying—it’s a reminder for both passengers and pilots.

Pokemon that can fly

With the emergence of the Pokemon Go app, even the older generations have become familiar with the well-known anime-based franchise. In fact, Pokemon remains influential in the gaming and anime industries, spawning numerous spin-off products and merchandise. This popularity is due to Pokemon’s appeal to both children and adults, resulting in a sizable market.

We believe these incredible Pokemon-themed airplanes must have captured a lot of attention as they moved from the runway. What a smart marketing move! Everyone is eager to see the pocket monsters; everyone wants to catch them all!

The Famed Walt Disney

This image is quite surreal—one man is giggling while the other appears downright eerie in his mask. For those who aren’t aware, the man on the left is the iconic Walt Disney. His name speaks for itself, as his business empire remains the largest in the entertainment industry.

It would be incredible if we could still communicate with him. And who knows? Perhaps one day soon we’ll create the technology necessary to bring his cryogenically frozen body back to life. Hearing his thoughts would be amazing.

Zany Personalities

Many of you likely don’t recognize this unusual group of characters, but they were well-known in their time. They were so highly regarded that Southwest Airlines enlisted them for promotional work in 1973. These characters brought happiness and joy to numerous people.

It would be amazing to have adorable creatures like these in our time. Encountering classic characters like Peter Panda, Huge the Shoe, Dirty Bird, and Connie Cone would be a fantastic throwback to the past.

A Comfortable Flight

It’s tough to sleep when you’re confined to a small seat for hours on end. However, this woman discovered a way to sleep like a baby by using the luggage area! It’s unclear how she managed to get in there or why nobody stopped her, but she succeeded.

We commend this woman who managed to evade the attention of the flight attendants and slept through the long journey in her own private sleeping space. Kids, don’t attempt this on your flight!

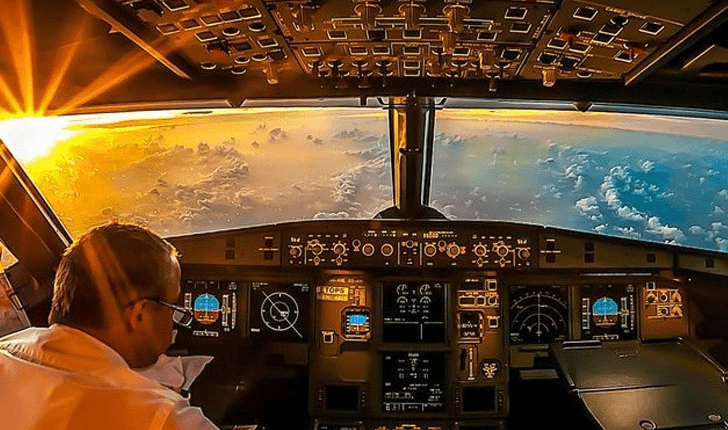

Selfies Taken by Pilots

Pilots are human as well, which means they enjoy taking selfies too! Although the media often portrays them as serious professionals, and while they are committed to their work, this picture reveals that there is more to them than just that.

It’s also proof that selfie culture is gaining popularity not only on land but also in the air. Now that’s a selfie worth taking!

An Aerial Perspective of The Sunrise

Sunsets and sunrises are some of the most breathtaking sights in the world. Many photographers make a living by taking amazing photos of these events. But have you ever witnessed a sunrise while soaring above the ground?

This picture allows you to witness its magnificence firsthand. These views of the planet help you understand how insignificant our problems are in the grand scheme of things.

Penguins in the Air

It’s not every day that you get to travel with cute animals on your flight. That’s why this photo of penguins getting on a plane is so incredible. Everyone loves penguins, and watching them perform ‘human’ activities makes them even more charming.

Penguins are adorable and affectionate birds that pair with a single mate for a lifetime. They cannot fly (unless traveling on airplanes), and their intriguing behavior is one of the many reasons they frequently appear in wildlife documentaries.

Vintage Cabin Crew

Flight attendants have been around since airplanes became commercial. They are trained to ensure passengers are content and to save their lives in emergencies. And they accomplish all this while maintaining a neat appearance.

Saving lives, providing service, and maintaining a stylish appearance can be quite a challenge, but these dedicated workers show it’s possible. Over time, flight attendants’ uniforms have undergone significant changes; this is how they appeared in the early days of commercial air travel.

Automated Footwear Polisher

Here’s something strange for you all. We can’t quite tell if these are characters from Ultraman because we’re too distracted by watching them get their shoes shined at an airport. It could be a marketing ploy, or maybe they just couldn’t resist having shiny shoes.

Oh yes, those are the Cybermen cyborgs from the

Doctor Who

Apparently, they were set up at the airport in anticipation of San Diego’s Comic-Con! It seems like everyone had a wonderful time taking pictures with them!

Adorable Small Pony

Many animals can collaborate effectively with humans. Today, numerous intelligent animals serve as therapy animals, aiding people with physical and mental challenges. They are trained to offer love and affection to their owners, providing comfort during difficult times and assisting them in navigating the world.

Having a therapy pony might be understandable, but bringing it onto a plane is a bit much, even if it looks adorable nestled up close to its owners. Who would have thought that ponies are not only cute but also have healing benefits!

Ducks on an Aircraft

You believed you’d witnessed everything after encountering penguins, ponies, and turkeys on a plane, but did you know that ducks also utilize air travel? We’re curious about where this little fellow was headed and what his human companion did with him during takeoff.

Can you picture that adorable little face waddling down the aisle? Ducks are calm creatures, and having them on a plane probably wouldn’t be as troublesome as having a pony!

A Joey

Kangaroos are intriguing creatures; female kangaroos keep their offspring in a pouch on their abdomen. They stand on two legs and use their hands in a manner that resembles human behavior.

Did we mention how cute they are? We understand that bringing animals on planes can be quite an issue. However, we believe that the reason this baby kangaroo was permitted on board is because it looks so sweet and innocent!

Contemporary Cabin Crew Members

Previously, we provided a brief overview of their history, and now it’s time to explore the appearance of today’s flight attendants (more often called ‘cabin crew’). Although much has evolved, their uniforms remain exceptionally stylish.

If flight attendants consistently smiled warmly like this, passengers would certainly feel more comfortable, even with the turbulence that often occurs on long-distance flights.

Is it necessary to scan this?

It’s common for belongings to be scanned by an X-ray machine at an airport. Dangerous weapons, illegal items, and contraband need to be identified to ensure the safety of all airport visitors.

However, this woman aimed to make the TSA feel completely at ease by including her baby in the scan. Is this meant as a joke, or was she actually serious? We sincerely hope the baby didn’t end up going through the machine!

Prepared for Miss Universe

Beauty pageants are becoming increasingly popular over the years due to the support of fans worldwide. Every hopeful beauty queen aspires to compete for the Miss Universe title, but unfortunately, only the top contenders qualify.

This is why contestants in the Miss Universe competition strive to reach at least the top five. Just participating in the event is a great honor, but standing out among the many delegates from various countries makes you exceptionally remarkable in the pageant world. Seen here is Chalita Suansane, a Miss Universe contestant from Thailand, with her 17 large pieces of luggage at the Ninoy Aquino International Airport in the Philippines.

Automatic frisking?

This is quite an odd device. We believe people are going too far with technology if this is to be adopted globally. Human hands work just fine, thanks!

Of course, it seems like this machine isn’t actually being used in an airport. Can you imagine how strange it would be to step into a machine that makes contact with your body? Wow!

Is Santa all right?

From his true story in medieval times to his portrayal every Christmas today, Saint Nick (also known as Santa Claus) has undergone a significant transformation.

Children worldwide hope he will visit on Christmas Eve to leave them lots of presents. He is, in fact, the reason they aim to be well-behaved all year long. Yet, why does he appear worried here? Santa, is there something you’re concealing?

Vintage Party Plane

Can you imagine that this was how air travel used to be? In the past, passengers were permitted to drink, smoke, party, and socialize during flights. A plane journey was essentially a party in the sky!

Today, only the extremely wealthy can enjoy sky parties on their private jets. Hopefully, one of the airlines will recognize the market for enjoyable flights and revive this classic tradition.

Guidelines for Participation

This ingenious feature at Aalborg Airport in Denmark gives travelers the opportunity to kiss and bid farewell to their loved ones before departing, as long as they limit their affection to 3 minutes. We can’t help but speculate whether there’s a security guard keeping track of the kiss durations.

We’re willing to bet that at least one couple has been together for more than 3 minutes because, really, who wouldn’t? Saying goodbye is tough!

Flight Crew Ready to Assist You

We’re not sure how this was permitted, but these flight attendants are dressed in very revealing outfits! It could have been part of a summer promotion, which would explain the departure from their typical uniform.

Regardless of the reason, we’re amazed that they can walk down the aisle in those huge go-go boots even during turbulence!

Oink Oink!

Is that woman thinking about putting her large pet in the overhead storage? We know how clever these animals are, but we weren’t aware they could be brought onto a plane.

If only everyone cared for their pigs with so much love and respect. If you enjoy bacon, then there’s no need to worry. After all, we can’t deny that we are omnivores. But we can at least ensure they are treated humanely when they die, can’t we?

A Major No-No

This photo clearly dates back several years. It was considered improper at that time and remains so today. Women ought to have the freedom to dress as they choose, while men should be educated to control their behavior.

This message should be shared worldwide: Men should behave like the adults they are and allow women the freedom to dress as they wish, without objectifying them.

Delicious bacon

Although humans enjoy consuming pork and bacon, pet pigs appreciate belly and back scratches and experience separation anxiety when their owners are not present.

Experiencing the sight of a pig on a flight, especially after stressful airport encounters, can truly boost your mood. They are intuitive to emotions and can quickly bring happiness. This one is such an adorable creature!

Quiet, Little One

Most people fear encountering a crying baby when they board a plane. Typically, once they start crying, babies continue for hours, and all passengers can do is increase the volume on their headphones. However, it makes sense that babies might feel confused and scared during flights.

In this situation, the flight attendants had to handle things themselves by working together to cheer up the children. Fortunately, the crying ended with a smile and all the passengers breathed a sigh of relief. Now, everyone can relax and get some well-deserved rest.

The TSA Confiscated Items Hall of Fame

This is quite an inventive method to let passengers know what they can’t take on a flight. Some might give up their items to the TSA after viewing this wall of fame.

This booth is situated at the Cleveland Airport and showcases a collection of confiscated items from past passengers to deter individuals from carrying illegal items and subsequently having them seized and displayed.

Smoking Cigarettes on Airplanes

In the early days of air travel, there were not as many regulations as there are today. People were free to drink and smoke whenever, whatever, and wherever they wanted. However, because of the confined space and the discovery of the negative effects of smoking, particularly second-hand smoke, smoking on planes has since been strictly banned.

Nowadays, smoking on an aircraft is a federal crime due to the harmful effects it has on others’ health. Although crying babies can be bothersome, just think about how terrible it would be if we continued to subject them to second-hand smoke on planes.

Urgent Mime Performance

In addition to appearing professional and possessing the skills to save lives, flight attendants must be trained to inform passengers of everything necessary for a safe flight.

Anyone who has ever been on an airplane is familiar with the routine—the flight attendants stand in the aisle to demonstrate the flight protocol and emergency procedures you need to follow. It appears that in the early days, they emphasized the mime element by giving the cabin crew white gloves!

Airplane Puppy

Imagine how charming it would be to have this fluffy head in front of you, intently watching an in-flight movie. We’re quite sure that passengers were thrilled to witness such an adorable creature enjoying itself during the flight.

Dogs are highly intelligent animals, able to show great love and loyalty. This is why humans have grown so fond of having them as companions, a tradition we’ve continued for centuries. Here’s hoping that pup is house-trained!

Who Needs Six Flags or Disneyland?

Packing your belongings is one of the most thrilling yet challenging tasks you have to handle when traveling. It can be enjoyable for some, as they get to plan their outfits, but it can also be stressful if you’re limited on space and anxious about forgetting items.

If airport security actually allowed you to ride your luggage on the conveyor belt, it would be amazing. Carrying luggage can be quite tiring, so reversing the roles and letting it carry you is a brilliant idea.

Oxygen Mask Celebration

During a flight, these oxygen masks were inadvertently activated. Fortunately, nothing serious is occurring. However, a few passengers might have taken the opportunity to enjoy a breath of fresh oxygen, departing from the cabin’s stale air for a moment.

The sudden drop of all the oxygen masks from the ceiling is an experience nobody wishes to have. But if it does occur, let’s hope it’s merely a harmless malfunction and not something affecting the engines!

Today’s Youth

The only thing more challenging than dealing with a crying baby on a flight is handling a group of rowdy teenagers. It’s clear there’s some disturbance going on, likely because this is their first experience flying without their parents.

We suspect that they are heading off to enjoy spring break without their parents. What are the chances that they’re going to Florida?

Whiskey and Pipes

This is what a first-class flight appears like. As we discovered earlier, there was a time when people were permitted to smoke on airplanes. However, the wealthy had the privilege to do so with elegance, enjoying premium whiskey, pipes, and other luxuries.

That’s correct; cigarettes weren’t the only things permitted on flights—pipes were also acceptable. Although the man looks quite stylish, we’re thankful that this is no longer allowed. Non-smokers can now enjoy peace and fresh air.

Who is that celebrity?

Nicolas Cage is one of the most well-known celebrities, making him easily recognizable when he walks in public places. But what occurs when you find yourself seated beside him on an economy class flight?

Given Cage and his eccentric behavior, he’ll likely snap an awkward selfie with you! The real question is, why was he in economy class? Everyone knows he’s wealthy. However, he is quite unconventional. Maybe he enjoys tight spaces and bad food? Or perhaps he just wanted some photo opportunities with fans.

Love story

The reason this photo is so special is that the couple, who are clearly in love, are heading off on their dream honeymoon, according to our source.

It seems they had just married in Las Vegas and won millions at the casino. Do you believe the money lasted long? Do you believe their relationship lasted too? We’d be interested in learning how everything turned out.

A Vintage Airplane Steward

Here’s another top-notch photo illustrating how luxurious air travel was in the past. Can you picture having a waiter serve you meals on a plane as if you were dining in a high-end restaurant? When you compare today’s in-flight meals to those offered back then, you’ll notice that a lot has changed.

Airplane meals used to be much more nutritious, and they weren’t served in foil trays. Instead, a sophisticated waiter would serve your meal. There was a real menu with a variety of food options available.

Military Punk Princess

Alright, let’s begin with the word ‘wow.’ It’s a daring style, and you have to give this punk-inspired military princess credit for her confidence and creativity. However, is this really a suitable outfit for a flight? We were always advised to wear soft and comfortable clothes!

If this isn’t the person’s typical fashion style, we suspect they might have lost a bet. If this is at the Las Vegas airport, the situation could be even stranger. What are your thoughts? Do you have any theories?

Hotel at the airport

Since it’s one of the most frequent sights you’ll encounter in an airport, it’s appropriate to conclude this list with another imaginative sleeper. Once again, we must commend this man for his boldness and inventiveness.

The newspapers are certainly a pleasant addition, as they keep his hands warm in the chilly air-conditioning, shield him from the harsh fluorescent lights, and overall provide a feeling of being in a secure cocoon. Sleep well!

Key Facts about Student Debt in the United States

- Women, Black borrowers, and those who attended for-profit universities had the greatest average federal student loan debt.

- Borrowers who attended for-profit universities had a greater default rate than those who attended non-profit or public institutions, owing to higher average debt levels as well as inferior earnings and job results.According to the most current statistics available, 34% of students who started their education at a for-profit institution in the 2011–2012 academic year and entered federal debt repayment by 2017 failed on their loans.Black borrowers have a high default rate of 29 percent, which is more than twice the white borrowers’ rate of 12 percent. This is partly owing to greater enrollment rates at such colleges.Women and men fail on federal loans at similar rates (17 percent and 16 percent, respectively).

- The amount of federal student loans in default or delinquent was growing before the federal government temporarily suspended payments because to the COVID-19 outbreak.The amount of such loans has almost doubled in the last several years, from $178 billion in 2016 to $263 billion in early 2020.

- According to Federal Reserve analysts, student debt may lower the homeownership rates of families headed by young people.The homeownership rate for all families fell by 4 percentage points between 2005 and 2014, while the rate for households headed by someone aged 25–34 fell by approximately 9 percentage points.Other studies have shown that student debt has ramifications throughout the economy, including stifling small company development, reducing Americans’ ability to save for retirement, and even delaying marriage and family formation.

- The benefits of the BB&T Vantage Checking account include tiered interest checking, fee reductions, and preferential lending rates.You may create a Vantage Asset Management brokerage account for even more freedom, allowing for quick sweeping into and out of your bank account.

- A personal private banker, the potential to earn interest on your balance, and bonus rates on chosen CD and IRA products are all included in the PNC Performance Select checking account.Customers also get charge exemptions and discounts on consumer credit products as a bonus.If you keep a monthly balance of $25,000 or more, the $25 account maintenance charge is waived.

- You can acquire a mortgage with little or no money down, but you may not want to.VA loans and USDA Rural Development loans (which apply to a lot of not-so-rural locations near cities) both provide mortgages with no money down.Conventional mortgages sponsored by Fannie Mae or Freddie Mac may enable you to put down as little as 3%, while Federal Housing Administration (FHA) loans only need a 3.5 percent down payment.These may be the difference between being able to purchase a house and not being able to, but keep in mind that you’ll be starting with little to no equity and will owe more than the property is worth if the value drops.

- It’s possible that your mortgage will be sold:It’s now fairly typical for a mortgage to be taken out with one lender and then sold to another.Your loan may be serviced by the other firm or your original lender, who will collect your payments.Although having your loan sold isn’t always a terrible thing, it may be jarring, particularly if you hoped to stick with your original lender.Don’t worry, the new servicer will be held accountable for the loan’s conditions.

- Borrowers who attended for-profit universities had a greater default rate than those who attended non-profit or public institutions, owing to higher average debt levels as well as inferior earnings and job results.According to the most current statistics available, 34% of students who started their education at a for-profit institution in the 2011–2012 academic year and entered federal debt repayment by 2017 failed on their loans.Black borrowers have a high default rate of 29 percent, which is more than twice the white borrowers’ rate of 12 percent. This is partly owing to greater enrollment rates at such colleges.Women and men fail on federal loans at similar rates (17 percent and 16 percent, respectively).

- The amount of federal student loans in default or delinquent was growing before the federal government temporarily suspended payments because to the COVID-19 outbreak.The amount of such loans has almost doubled in the last several years, from $178 billion in 2016 to $263 billion in early 2020.

- According to Federal Reserve analysts, student debt may lower the homeownership rates of families headed by young people.The homeownership rate for all families fell by 4 percentage points between 2005 and 2014, while the rate for households headed by someone aged 25–34 fell by approximately 9 percentage points.Other studies have shown that student debt has ramifications throughout the economy, including stifling small company development, reducing Americans’ ability to save for retirement, and even delaying marriage and family formation.

Essential Statistics About Mortgages

- Home prices vary by state and other circumstances, but mortgage statistics in the United States indicate that the average balance has risen gradually over time.Indeed, it has risen by more than $55,000 since 2007.The increase is mostly due to rising property prices, particularly in California, New York, and Colorado.

- Buying a new home with cash is not an option for most Americans, particularly if it is their first home.It would take decades to accumulate that sum of money, particularly because house prices in numerous areas, including Idaho, Utah, Tennessee, Georgia, and Arizona, are rapidly rising.As a result, all mortgage sector figures predict a future increase in house loans.Mortgages are the only viable option for young individuals who want to purchase a property.

- Real estate values are growing, indicating a market that is rebounding from the Great Recession.In fact, almost $4 trillion has been added to this figure in the last five years, and the trend seems to be continuing.A fresh recession, on the other hand, may disrupt such expectations.

- In comparison to 2004 figures, mortgage loan statistics reveal an almost 5% reduction in owner-occupied house ownership.The data reveals the continued concentration of real estate wealth among a small number of owners, as well as the tightening of lending criteria in the aftermath of the Great Recession.Consumer skepticism is another factor:Following the previous financial crisis, some consumers are still hesitant to take on debt.

- Finance gurus and mortgage lenders have traditionally advised you to put down a 20% down payment on your new property.In today’s real estate world, this counsel has evolved from practical to aspirational.Many properties are now available for purchase with just a 1% down payment.Rising property prices are cited as a major influence in mortgage origination data, and there is little indication that this trend will reverse very soon.

- Since 2011, statistics indicate a continuous growth in the number of new and existing residences sold in the United States.The overall number of property sales in that year was 4.75 million, while forecasts for 2019 anticipate a total of 6.44 million.In less than a decade, that’s a 26.2 percent gain.It denotes the country’s economic recovery since the conclusion of the global financial crisis in 2009.

- Statistics from the mortgage business show a significant movement toward non-bank lenders.Independent lending firms have risen to prominence as a result of the transformation.These non-banks have increased their market share from 9% in 2009 to almost equal that of banks.Non-bank lenders made up five of the top ten mortgage lenders in 2019.Quicken Loans is the biggest.

- While a large rise in overall mortgage debt may seem to be a negative indicator, it is really a sign of an improving economy.Mortgage debt figures have been declining for years due to industry stagnation after the financial crisis of 2008.Rising mortgage debt, particularly on new mortgage loans, shows that the economy is finally improving and that consumers are growing confident in their decision to buy a home.

- Because the value of real estate assets has climbed to $25.6 trillion, Americans now enjoy the largest degree of equity in the country’s history.The previous high point was attained in 2005, when total house value reached $13.41 trillion before plummeting due to the financial crisis.This time around, the economy is considerably more solid, and the gain in equity provides homeowners with greater security.

Celebrities Who Give Away Their Millions

- Elton John contributed a stunning $46 million in 2017, according to the Sunday Times Giving List.The bulk of the money went to his charity, the Elton John AIDS Foundation, which has offices in both the United Kingdom and the United States.Over the last 25 years, the two foundations have raised around $385 million.

- Will Smith and Jada Pinkett Smith have donated millions of dollars to aid the less fortunate throughout the years.They established the Will and Jada Smith Family Foundation, which has given grants to a range of charities including the Baltimore School for the Arts, the Make-A-Wish Foundation, and the Lupus Foundation.

- The Pitt-Jolie power couple was no stranger to assisting the less fortunate prior to their split.Pitt is a humanitarian and Jolie is a UNHCR Goodwill Ambassador.Over 60 charities were supported by the pair.The pair donated the proceeds from the sale of the first photographs of their twins, Knox and Vivienne, to their Maddox Jolie-Pitt Foundation, which is committed to community development in Cambodia.

Statistics About Mortgages

- The delinquency rate on home debt is the strongest indicator of the economy’s continuous recovery.The rate reached an all-time high of 11.54 percent in January 2010.It has been steadily declining since then, and it is presently at an all-time low.This data implies that Americans are good at managing their mortgage debt.

- Banks are making it more difficult to get a home loan.The current baseline of 758 is higher than the previous high of 708 set in 2006, although it is not the highest it has ever been.In reality, in 2012, when the average credit score was 781.23, the highest credit score threshold was required.Since then, lenders have been steadily relaxing qualifying restrictions.

- When it comes to financing a new house, mortgages are still the most popular option.Yes, many individuals find the mortgage application process stressful.They do, however, recognize the benefits of having real estate.In any case, they apply.

- Instead of meeting with a loan representative one-on-one, fintech lenders enable house purchasers to submit papers and complete applications online.They’re fast gaining popularity.Fintech’s participation of the mortgage industry in 2010 was under 2%, or $34 billion in loan originations.Mortgage data from 2016 shows an increase of 8%, or $161 billion.Lenders have every motive to accelerate the use of fintech solutions in the future, thanks to continuing service improvements and lower technological costs.

- On average, using a fintech lender may save processing time by ten days, or 20%.Depending on the kind of loan you want, you may be able to save even more time.Homeowners who refinance their property, for example, notice a 14.6 percent decrease in loan processing time.The average processing time for conventional home-purchase mortgages has been cut by 9.2 days.

- Since hitting a record low in 2012, mortgage rates have ranged between 3% and 4%, according to mortgage rate data.The rate almost hit 5% in the fourth quarter of 2018, although it has subsequently fallen.The highest mortgage interest rate in history occurred in 1981, when it hit an all-time high of 18.63 percent.

- Young people seem to be afraid of house ownership and large loans, yet the number of properties sold to them is constantly growing.Since the previous year, the proportion has increased by 2%.Around 70 million millennials live in the United States.For today’s lenders, this group is the most crucial demographic.

- The mortgage market is evolving as a result of technological advancements.Younger purchasers, who have grown up in a digital environment, anticipate speedier services, which fintech solutions provide.Despite this, the majority of respondents indicate they would prefer to speak with a person throughout the most essential stages of the procedure.

- This exemplifies the importance of the internet in the mortgage sector.Only 57 percent of consumers said they did internet mortgage research ten years ago.Borrowers spend the most time researching the best rates, followed by loan possibilities and lender reliability.

- According to mortgage loan data, speed is a top priority for 29% of those who take out loans online.Security, at 28%, and simplicity, at 20%, are two other major criteria.Other variables score substantially lower, indicating that borrowers value these three considerations above all others.

- One of the reasons for non-banks’ fast expansion is their inability to adapt to automated operations.Over the last six years, digital lending services have grown at a breakneck pace.By 2020, digital lending is estimated to reach $122 billion, making it a significant concern for banks.

- Mortgage fraud figures reflect an alarming trend: from 2017 to 2018, fraud on new mortgage applications increased by a whopping 12.4 percent in a single year.According to analysts, this is mostly due to income fraud:Buyers respond to rising prices by inflating their income in the hopes of obtaining a mortgage.

- Since its legalization in 1990, more than a million reverse mortgages have been taken out by senior individuals.According to reverse mortgage data, both rich and middle-class homeowners find the ability to pull cash out of their houses useful.Some people use money to better their lifestyle, while others use it to pay off debt or save for retirement.